Proof of Work

Everyone knows the golden rule: He who has the gold makes the rules.

A core purpose of Trace Mayer is to be a champion of monetary sovereignty through non-violent cryptographic means for individuals to protect and preserve their agency and freedom from oppression in the very controversial political battle over money and property rights.

To further that purpose, he was the first popular blogger to step onto the battlefield of ideas and publicly recommend the powerful blockchain technology Bitcoin with a market capitalization under $2m

In 2003, Trace obtained a bachelor degree in accounting and later a law degree. During law school he researched and wrote a paper on monetary jurisprudence. This was the catalyst for his diving into the field of monetary science.

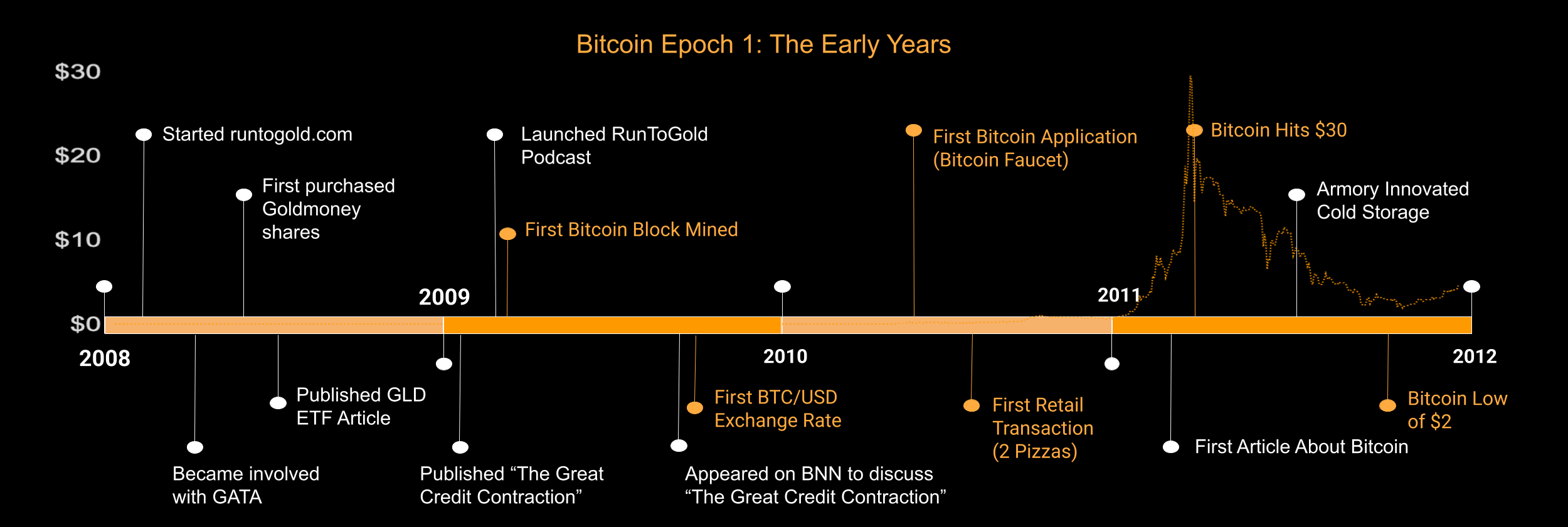

Trace started Run to Gold in 2008. This platform eventually became one of the earliest sources that provided educational and philosophical content on Bitcoin. Trace disseminated original ideas and education to the world about this innovative magic Internet money.

During 2008 he attended the Global Anti-Trust Alliance (GATA) conference and had breakfast with Dr. Vieira, author of Pieces of Eight.

Run to Gold continued providing education and in 2009 Trace launched its podcast which opened the doors to anyone interested in diving deeper into this space of monetary sovereignty.

In Fall 2009, Bloomberg News hosted Trace as a guest to discuss The Great Credit Contraction and the liquidity pyramid.

Other notable events between 2008-2012 include:

- Analysis of the GLD ETF Prospectus

- First published article about Bitcoin

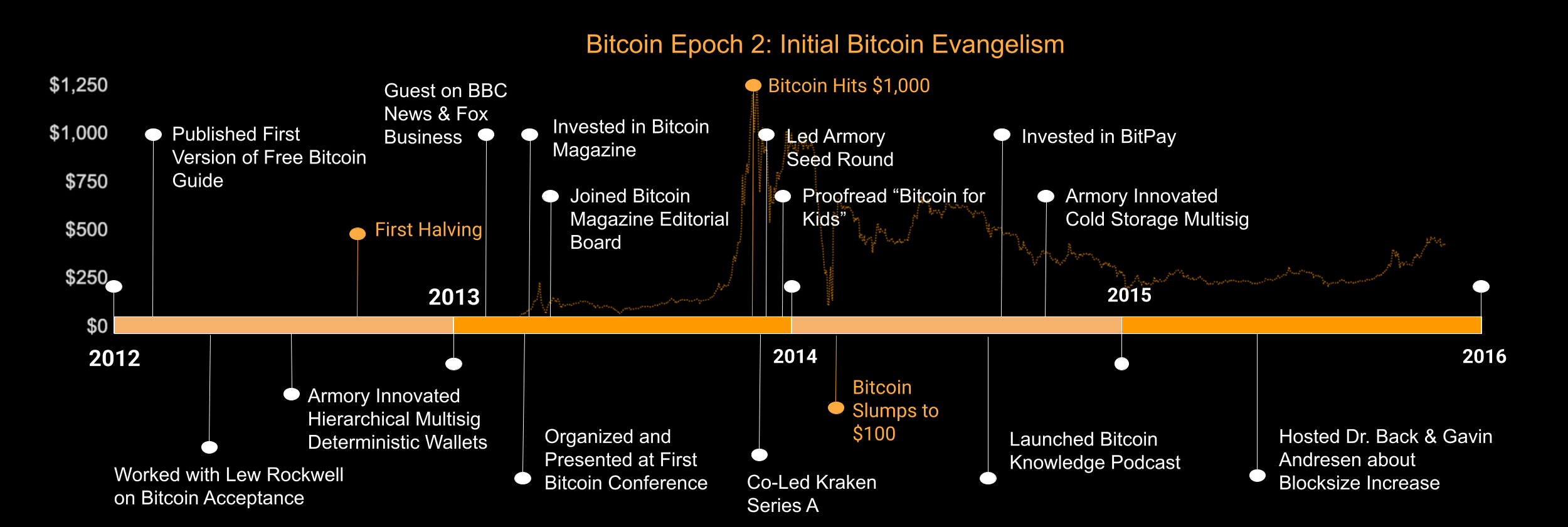

Following his initial success, his presence and knowledge continued gaining a larger and larger following. He released his first version of a Bitcoin Guide in 2012, absolutely free to the general public. At the end of 2012, Trace continued his partnership with Armory, and they entered the first seed round of funding.

Trace’s public presence and impact took off in 2013. He was a guest on multiple news outlets, sharing his expertise and authority on Bitcoin and its ability to transform the money market and the world we live in. A few of many key moments that solidified his place as an expert in the industry:

- March: BBC Newsnight Guest

- April:

- Joined the Bitcoin Magazine Editorial Board

- Fox Business Guest

- May:

- Organized and presented at the 2013 Bitcoin Conference

- Armory seed round of funding/investing

- October: Proofread Bitcoin For Kids

- December: Kraken - Co-led Series A investment round with Hummingbird

The Bitcoin Knowledge Podcast was launched in early 2014, giving way to more knowledge sharing for Bitcoin and the money market. Some of the notable guests over the years have included Saifedean Ammous, Caitlin Long, Adam Back, and Stephen Livera.

Soon after the launch of the Bitcoin Knowledge Podcast launched, Armory entered its cold storage mutisig phase in April 2014, giving crypto wallets a secure way to store currency for the private keys required for transactions, resulting in the utmost protection from theft.

Trace’s momentum only gained in the following years. In 2015, he presented an impromptu speech at the Bitcoin Event at LaGuardia Community College: The Future of Cryptocurrency. There, Trace discussed what the future would be for Bitcoin and why. He dove into the background of Bitcoin, his investments, use cases for Bitcoin, and network effects with Bitcoin.

Another 2015 feature moment was when Trace hosted Dr. Back and Gavin Andresen about the block size increase to larger than 1MB. During this time, there were many debates about whether this was the right move to make and were coined The Blocksize Wars. While nothing was resolved at this time, it did lead to larger conversations for the future and the ultimate implementation of SegWit that allowed for Bitcoin’s scalability.

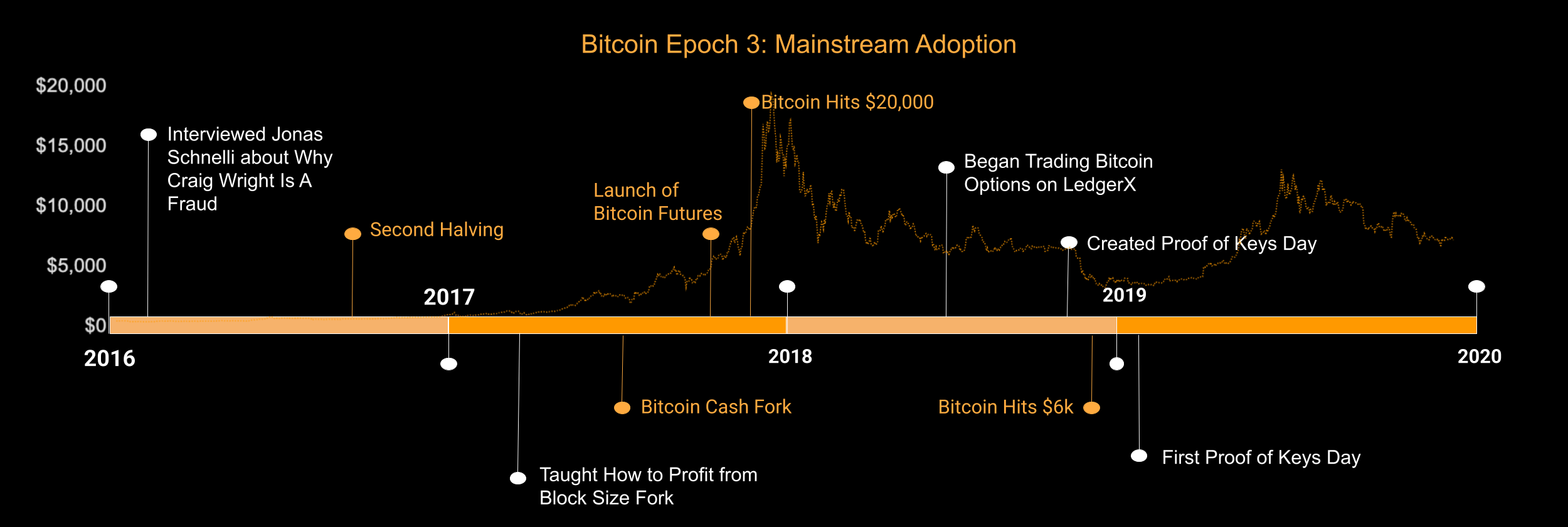

Trace had the opportunity to interview Jonas Schnelli in 2016, and they examined the hot topic of why Craig Wright is a fraud. Wright had claimed to be a driver and creator of Bitcoin, which is widely accepted as a false claim.

Also in 2016, Trace extensively shared and discussed the Liquidity Pyramid. He provided this as an example of various currencies and their level of safety and, as one may guess, liquidity - like gold and Bitcoin.

The Blocksize Wars continued in 2017, and Trace was a key contributor to the discussion, supporting keeping the smaller block size and maintaining Bitcoin’s decentralized nature. He taught how to profit from the eventual block size fork, which would progress to the goal of financial privacy and provide more long-term options for wealth.

In late 2018, Trace saw the need for and created Proof of Keys Day. This event encourages Bitcoin holders to take full control of their keys, taking their coins off exchanges and into their own wallets for one day - all to prove rightful ownership of. All of this is to promote the belief “not your keys, not your Bitcoin”. The first Proof of Keys Day was January 3, 2019, and was a huge success with thousands attending throughout the world. The exact number cannot be reported, as there is no centralized registration or formal tracking, which is in line with the core ideas of Bitcoin. Proof of Keys Day has continued every January 3rd since and remains a social media blitz.

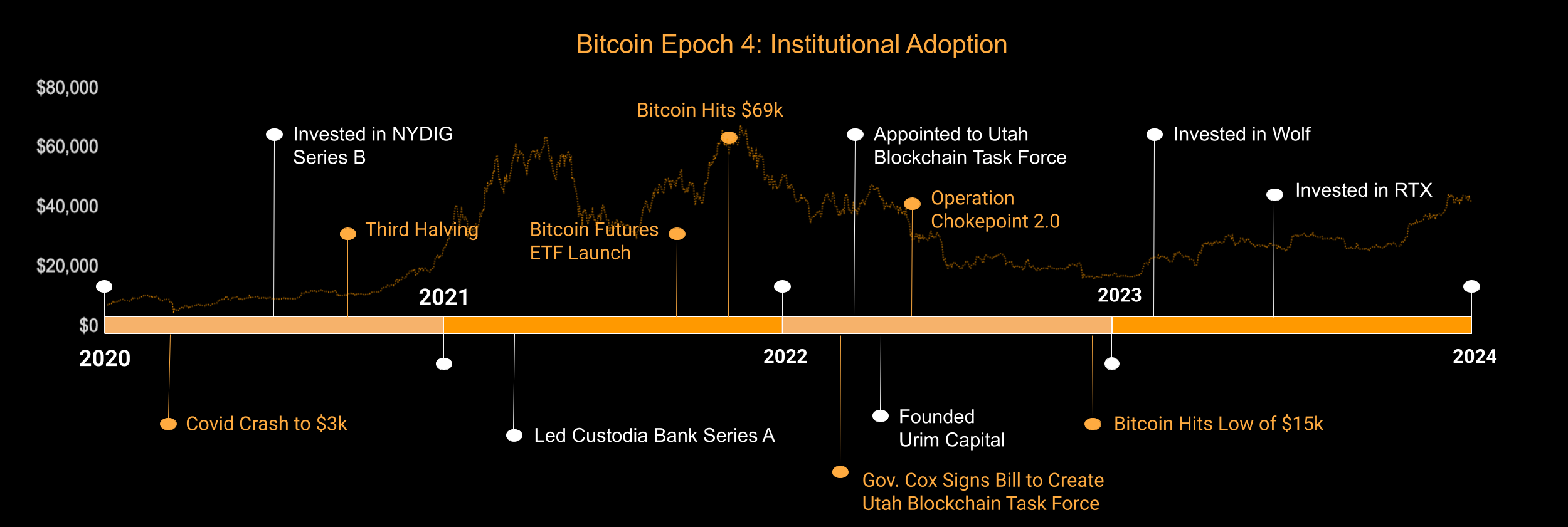

Starting in 2020, Trace’s investments really started to climb. In Q4 2020, he helped New York Digital Investment Group (NYDIG), a Bitcoin-focused financial firm, scale and take off through his Series B funding.

Following his NYDIG investment, he also

- Led the Custodia Bank Series A funding (2021), a specialized digital asset bank

- Invested in Wolf (2023), a lightning incubator with NYDIG

- Invested in RTX (2023), a swap dealer focused on efficiency, liquidity, and dependability

While increasing his investing footprint during the wave of institutional adoption, Trace was also instrumental in driving forward regulatory progress. In March 2022, Utah Governor Cox signed the bill to create the Utah Blockchain Task Force. That same month, Trace was appointed to the Utah Blockchain Task Force.

His most recent investment and business venture was founding Urim Capital in 2022. This firm is focused on early-stage cryptocurrency related projects, real estate, and software development.

This is not the end for Trace, but rather a continuation of infinite possibilities.

The main purpose of Trace Mayer's work, almost all of it provided to all mankind for free and at great risk to himself since tyrants love to silence the conscience, is to provide ideas and information on monetary science and economics that will help prepare people to combat the extremely dangerous false ideas currently in the marketplace that are causing many undesirable and harmful effects worldwide.

Ideas can only be overcome by other ideas. Money and force are impotent against ideas. Government abuse of currency has enabled many evils including the rise of dictators and perpetuation of genocide. The abandonment of sound money is the chief reason, if not the only reason, that the world has become such a dangerous place.

These issues are not new and have been thoroughly explored by the world's greatest polymaths. In 1722, polymath Emanuel Swedenborg wrote a paper to the Swedish House of Nobles concerning the negative effects of inflation and benefits of sound money.

I wonder how much care for the kingdom's welfare people have who insist on deflating the currency "for the good of the country" in spite of the fact that the country's main source of wealth is put at risk. It is clear how much domestic trade depends on the value of currency: it is founded on it, and a devaluation would affect not only the currency but also far more important matters.

When a harmful custom becomes habitual in a country, does not that custom acquire power and authority? Whatever the reason, it may become more and more firmly entrenched, and ultimately invincible. I would here argue that it is not easy to change something that has gained strength over so many years and in so many instances.

In 1832, polymath Johann Wolfgang von Goethe published Faust Part Two, his magnum opus and considered to be the greatest work of German literature, which warned about the deleterious effects stemming from abuse of currency starting on line 4,925 .

In 1844, United States Presidential candidate Joseph Smith said:

I consider that it is not only prudential, but absolutely necessary to protect the inhabitants of this city from being imposed upon by a spurious currency...I think it much safer to go upon the hard money system altogether. I have examined the Constitution upon this subject and find my doubts removed...

Article I, Section 10 declares that nothing else except gold and silver shall be lawful tender...The different states, and even Congress itself, have passed many laws diametrically contrary to the Constitution of the United States...The Constitution acknowledges that the people have all power not reserved to itself.